The Role of Mining in The Race to Net Zero Emissions

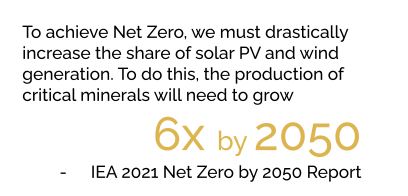

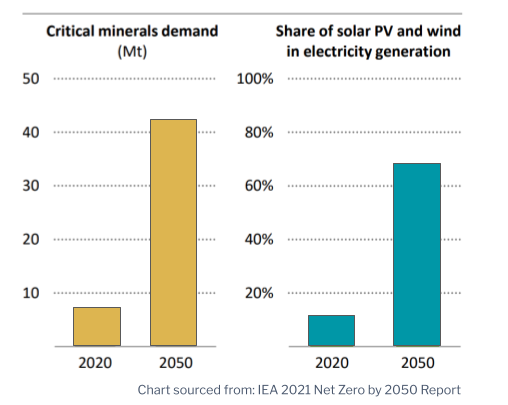

As the world progresses toward the renewable energy transition, the demand for minerals increases exponentially. According to the International Energy Agency (IEA), 2021 Net Zero by 2050 Report, critical mineral production needs to grow four to six times in order to combat climate change.[1] The need for raw materials used in solar, wind, and electric vehicle (EV) infrastructure is already causing an increase in mineral prices. Growth in the market share of EVs and battery storage has caused a cascading surge in demand for lithium, nickel, and cobalt, as well as several other critical materials.

At the same time, there also is mounting pressure on the mining industry to commit to net-zero greenhouse gas (GHG) emissions, ensuring the minerals to support the clean energy economy are free of emissions.

At the same time, there also is mounting pressure on the mining industry to commit to net-zero greenhouse gas (GHG) emissions, ensuring the minerals to support the clean energy economy are free of emissions.

Earlier this year, The European Union (E.U.) finalized a bill that will create a legally binding 2050 net-zero emissions and a target of 55% below 1990 levels of CO2e emissions by 2030 for companies operating in the E.U.[2] President Biden signed the IRA into law in August of 2022, with the most significant climate legislation in US history, spending more than $369 billion over the next ten years to achieve a target of 40% below 2005 emissions levels. Climate legislation is advancing globally, and shareholders around the world are demanding change. With the inevitable growth in the mining sector, coupled with the need to decarbonize, there is a race to net zero.

What Is GHG Net-zero Mining?

GHG Scopes 1, 2 & 3

Carbon or GHG net-zero mining is where all fuel and energy come from renewable sources, free of GHG emissions, and the upstream and downstream emissions associated with mining activities are mitigated. According to the Net Zero by 2050 report from the International Energy Agency (IEA), “The world has a viable pathway to building a global energy sector with net-zero emissions in 2050 . . . it requires a complete transformation of how we produce, transport and consume energy, with a large deployment of renewable energy and an end to sales of internal combustion engines by 2035.”

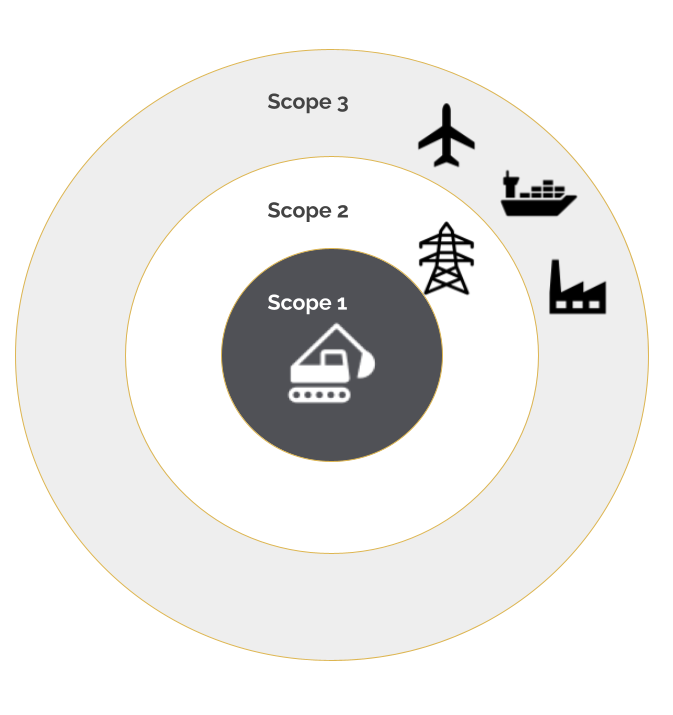

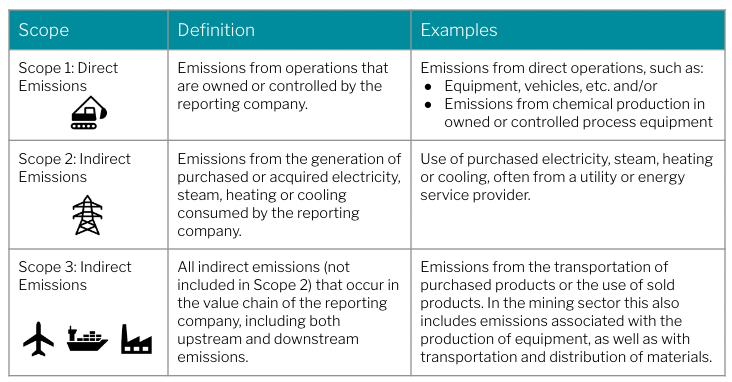

GHG emissions are divided into three scopes, as shown in the image to the right and described in the table below.

How Significant Are Emissions from Mining?

“Mining is responsible for four to seven percent of global GHG emissions in terms of the sector’s Scope 1 and Scope 2 emissions. Including Scope 3 emissions links, the sector contributes to around 28% of global emissions.”[3]

This scenario has created an increased demand for transparency, traceability, and lower emissions by mining customers, investors, and government entities. Given the ever-growing awareness around GHG emissions and climate change, mining companies and other GHG emitters likely will only face more scrutiny in the years to come. And, as always, money talks; while regulatory bodies may move slowly in their efforts to curb emissions, shareholders are not as patient. If a move toward more sustainable operations can help ease public pressure, build trust, reduce scrutiny and, in turn, improve the bottom line, shareholders will demand it. Investors are placing pressure on mining companies to take responsibility for Scopes 1, 2, and 3. Larry Fink, chief executive at BlackRock, the world’s largest fund manager, said “climate risk is investment risk,” and in 2020 published a letter stating the group would “place sustainability at the center of its investment approach.”[4] Climate Action 100+, an investor-driven initiative, already has 450 signatories and represents over $40 trillion in assets. The initiative is focused on getting high-emission companies to agree to net-zero targets. Allison Forest, responsible investment officer at Resource Capital Funds, and giving the keynote talk at the American Exploration & Mining Association (AEMA) Conference in Reno, Nevada, stated “if mining companies want to get capital from us and other institutions like us, climate disclosure is important.”

Climate Change Risks to Mining Sector

The mining sector is particularly vulnerable to climate change and climate change mitigation is in the sector’s best interest. “Trucost research, which analyzed mines owned by the top 20 miners by market capitalization, showed that on average, 11% of the mines’ profits could be at risk by 2025 due to potential increases in carbon regulation costs and higher water costs due to changes in climate.”[5] In 2019, 96 institutional investors representing $10.3 trillion in assets issued an open letter to 658 mining companies requesting public disclosure on 20 specific questions about climate risk related to tailings dams.[6] Stakeholder trust and shareholder investment are strongly linked and at risk in the mining sector due to climate concerns. As the world wakes up to the impacts of climate change, stakeholders are demanding all companies across global value chains take action. “Mining companies should recognize that there is a correlation between stakeholder sentiment and company valuation,” said Henry Stoch, Partner, and the Risk Advisory and National Sustainability and Climate Change Leader at Deloitte Canada.[7] “Companies that fail to commit to a decarbonization agenda could find their share prices affected, which strengthens the case for decarbonization.”

Evolving Priorities of Mining Companies

Mining companies are listening to stakeholder and shareholder demands for decarbonization. Along with a dozen top mining companies such as BHP, Vale SA, and others, Anglo American in Australia CEO Tyler Mitchelson committed the company to carbon-neutral operations by 2040, with the aim to reduce Scope 3 emissions by 50% in the same timeframe.[8] In doing so, the company has taken on large initiatives, including the development of a 220-tonne hydrogen fuel cell haul truck in partnership with Engie, NPROXX, First Mode, Williams Advanced Engineering, Ballard, ABB, Nel, and Plug Power.[9] “Displacing our use of diesel is critical to eliminating emissions at our sites and along our value chain. We believe that our innovative hydrogen-led technology provides a versatile solution, whether for trucks or trains, or other forms of heavy-duty transport,” says Anglo American’s Technical Director Tony O’Neill.

It’s not just the largest mining companies that are taking action. According to a 2020 White & Case survey of mining sector companies, over 26% of respondents said Environmental, Social, and Governance (ESG) policies will be the main priority for the mining sector, and over 12% said climate change response would be the top priority.

When combined, ESG and climate change response emerge as the top priorities for mining companies. This makes sense given the mining sector’s unique climate change vulnerability from both a financial standpoint, stakeholder concern, and physical infrastructure risk.

Why Haulage Matters in Reducing GHG Emissions

For most mines, Scope 1 and 2 emissions come from energy used in mining operations, either in the form of fuel or electricity. These are also among the top operational expenditures (OPEX). If a mine can reduce Scope 1 emissions or move emissions from Scope 1 (emissions from the burning of fossil fuels) to Scope 2 (emissions from the purchase of electricity), the pathway to net zero emissions opens up, often resulting in OPEX savings.

In the mining sector, diesel fuel is the biggest source of direct GHG emissions, and haulage often represents the largest source of diesel emissions. Where a mine can electrify its hauling operations, it can significantly reduce GHG emissions and lower costs. Large haul trucks have been the industry standard for over 50 years and offer flexibility, relatively low capital cost (especially with equipment lease options), and guaranteed technology with known maintenance. With the emergence of adaptable, affordable, and reliable electric hauling options that improve a mine’s overall economic performance and lower emissions, the challenge will be to justify the continued use of diesel.

When fuel switching (from diesel to electric or hydrogen) to reduce GHG emissions, the new fuel source is likely cleaner and cheaper than burning diesel. In most places, electricity is both cheaper and cleaner than diesel. As the world continues to decarbonize the grid, renewables are becoming a larger share of the grid mix. In 2020, according to a report from the World Economic Forum, renewables (solar and wind) became the cheapest form of energy. [10]

In places where grid electricity is more expensive or unavailable, onsite renewables can be a cost-competitive option, especially when paired with equipment electrification or partial electrification. Warm Springs Consulting (WSC) provided sustainability analysis for the Integra DeLamar mining project in Southwest Idaho, U.S., which was published in the DeLamar Pre-feasibility Study (PFS). WSC’s job was to look for pathways to reduce emissions and costs simultaneously. In close collaboration with the mining engineers designing the project, the WSC engineering team analyzed the tradeoffs between an electric light rail haulage system (Railveyor) that generates electricity on downhill hauls and diesel haul trucks for a portion of the ore haulage. Even with pre-inflation fuel prices, the economic advantage of light rail was clear. The case for electrification grows as fuel prices increase. Also, our team compared a large powerline upgrade from the utility to onsite energy generation through solar, batteries, and natural gas – which also had a clear economic advantage. The Levelized Cost of Energy (LCOE) for the microgrid was 64% less than the LCOE for the line upgrade and energy purchase from the utility.

Between electrification and onsite renewable energy generation, the DeLamar project will reduce costs by more than $83 million and GHG emissions by more than 165 thousand metric tonnes of CO2e over the estimated 16-year mine life.

WSC continues to provide guidance and support to Integra Resources Corp. for creating an energy work plan that includes electric vehicle technologies and clean energy generation infrastructure best suited to their operations.

The WSC technical team conducted a study (Materials Transport: Racing to Net Zero) to dive deeper and explore which haulage option emerged with the lowest cost and lowest emissions, by comparing seven haulage options in terms of greenhouse gas emissions, and operating and capital costs. The study team evaluated 1) Diesel-Electric Haul Trucks, 2) Battery-Electric Haul Trucks, 3) Fuel Cell Haul Trucks, 4) Railveyor, 5) Diesel-Electric Heavy Rail, 6) Long Haul Diesel Trucks, and 7) Conveyor.

This analysis looks at both the emissions and costs associated with operating the equipment (fuel and electricity), the embedded emissions and costs associated with the construction and installation of the equipment itself, and the associated infrastructure (roads, powerlines, and rail). While this analysis focuses on mining operations, the energy and emissions factors can be applied to haulage for other industries. The clear winner in terms of cost and emissions was Railveyor (light rail), with heavy rail in a close second, followed by conveyors, then Battery Electric Vehicles (BEVs), then the (not yet market available) hydrogen fuel cell vehicles, and then diesel trucks.

In a typical mining operation, diesel fuel is the biggest source of direct GHG emissions, and haulage is often the main source of diesel emissions. If a mine can electrify its hauling operations, it can significantly reduce GHG emissions and lower costs. Large haul trucks have been the industry standard for over 50 years and offer flexibility, relatively low capital cost (especially with equipment lease options), and guaranteed technology with known maintenance. The challenge will be to justify their continued use when there are more economical options that lead to significant reductions in GHG emissions.

To learn more about our work, subscribe to our blog or send us a message.

References:

[1] IEA. (2021, May). Net Zero by 2050.

[2] European Climate Foundation. The ‘Fit for 55’ package at a glance. May 22, 2022.

[3] Delevingne, L., Glazener, W., Grégoir, L., & Henderson, K. (2020, January 28). Climate risk and decarbonization: What every mining CEO needs to know. McKinsey Sustainability.

[4] Fink, L. (2020). Larry Fink CEO letter. BlackRock.

[5] Kuykendall, T. (2020, July 28). Path to net zero: Miners are starting to decarbonize as investor pressure mounts. S&P Global Market Intelligence.

[6] Owen, J. R., Kemp, D., Lèbre, É., Svobodova, K., & Pérez Murillo, G. (2020). Catastrophic tailings dam failures and disaster risk disclosure. International Journal of Disaster Risk Reduction, 42.

[7] Deloitte. (2021). Tracking the trends 2021: Closing the trust deficit. Deloitte Insights.

[8] Iannucci, E. (2021, December 13). Anglo American and Aurizon study hydrogen trains. Mining Weekly.

[9] Preyser, J. (2021, December 21). Miners experiment with hydrogen to power giant trucks. BBC News.

[10] Masterson, V. (2021, July 5). Renewables were the world’s cheapest energy source in 2020. World Economic Forum.